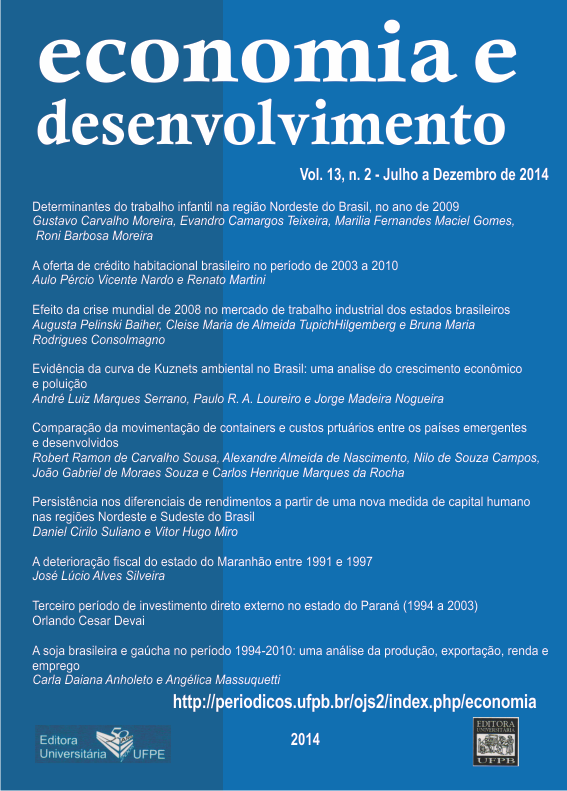

A OFERTA DE CRÉDITO HABITACIONAL BRASILEIRO NO PERÍODO DE 2003 A 2010

Resumo

O objetivo deste trabalho é analisar a liberação de crédito habitacional, focando a atenção sobre os financiamentos liberados pelo Banco Central do Brasil e nos Certificados de Recebíveis Imobiliários (CRIs). Estes certificados segundo a teoria econômica que explica o efeito multiplicador podem aumentar o volume de negociações dentro de um país sem alterar a quantia de moeda em circulação, ou seja, através de especulação de títulos provenientes de financiamentos imobiliários os agentes econômicos negociam no mercado de ações pequenas, ou algumas vezes não tão pequenas, cotas de um imóvel ainda financiado. Esse sistema de financiamento cresceu no Brasil segundo o Banco Central com maior vigor após os anos de 2004 em diante. Por esse motivo, associado ao fato de se configurar o mandato de um único presidente, bem como a disponibilidade de dados, foram selecionados os anos entre 2003 e 2010, com os dados sendo provenientes de sites do Banco Central do Brasil (BCB), da empresa CIBRASEC, da empresa Brazilian Securities e da Comissão de Valores Mobiliários (CVM). O aporte teórico é dado pela revisão das principais características do sistema de criação de crédito e o desenvolvimento do Sistema Financeiro Habitacional. Nos resultados e discussões analisa-se o desenvolvimento do Sistema Financeiro Habitacional focado na evolução dos dados sobre a oferta de crédito no período selecionado. Posteriormente volta-se para a evolução dos níveis de endividamento das famílias e empresas. O aumento da oferta do crédito imobiliário associado à redução dos níveis de endividamentos, concomitante a reduzida relação crédito imobiliário/PIB brasileiro em relação a outros países conclui-se que o crescimento do crédito habitacional no Brasil no período de 2003 a 2010 foi sustentável, e sugere-se que há espaço para políticas de estímulo no setor sem o risco de gerar uma bolha especulativa.Downloads

Não há dados estatísticos.

Downloads

Publicado

2015-11-23

Edição

Seção

Artigos